How to Use Financial Ratios to Analyze Cash Flow?

Ever felt like your business is doing great, but you’re still scrambling to pay the bills? You’re not alone. This is a common struggle for entrepreneurs. Without proper cash flow, even the most successful business can hit rough waters.

In this blog, we’ll explore how you can turn things around by using financial ratios and the right cash flow management software.

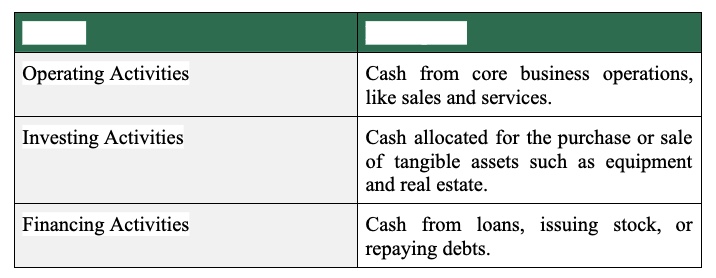

Fundamental Concepts of Cash Flow

Unlike profit, which reflects what’s left after expenses, cash flow shows how much cash you actually have available right now. It’s a real-time measure of your financial health.

Here are the key sections found in a cashflow statement:

By using cash flow management software, you can significantly improve your approach to business finances in several ways:

- Timely Payroll

- Strong Supplier Relationships

- Growth Flexibility

- Emergency Buffer

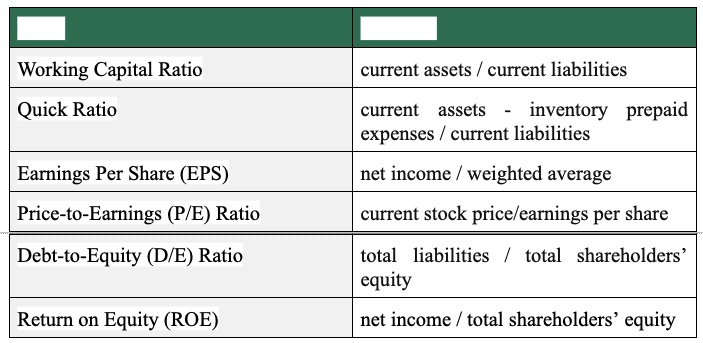

Essential Financial Ratios for Cash Flow Analysis

Financial ratios are your business’s quick diagnostic tool. By leveraging the following ratios, you can assess potential investments and measure your company’s performance against industry benchmarks.

Detailed Examination of Key Ratios

Each of the ratios provides a unique perspective on a company’s financial situation. To understand how the best cash flow businesses manage their finances, let’s look at some examples:

Working Capital Ratio is your go-to for checking liquidity. Take Company A: with $4 million in assets and $2 million in liabilities, it boasts a ratio of 2. This means it has double the assets needed to cover its debts.

Quick Ratio measures only the assets that can be quickly turned into cash, leaving out inventory. For Company B, with $5 million in total assets but $1 million tied up in inventory and $3 million in liabilities, a quick ratio of 1.33 means it can cover its short-term obligations with its readily available assets.

Earnings Per Share (EPS) tells how much profit each share is pulling in. Company C, with a net income of $2 million and 1 million shares, has an EPS of $2. This means each share is making $2, giving a clear picture of the company’s profitability.

Price-to-Earnings (P/E) Ratio shows what investors are willing to pay for each dollar of earnings. For Company D, with its stock priced at $40 and an EPS of $4, the P/E ratio of 10 shows that investors are shelling out $10 for each dollar of earnings. This gives you a glimpse into how the market is valuing the company.

Debt-to-Equity (D/E) Ratio is all about balance. For Company E, which has $6 million in debt and $9 million in equity, the D/E ratio of 0.67 shows a balanced approach to debt and equity, indicating a moderate level of financial risk.

Return on Equity (ROE) reflects how well a company turns shareholder investment into profit. Company F, with $1.5 million in net income and $7.5 million in equity, has an ROE of 20%. This means it earns 20 cents for every dollar of equity, reflecting a strong performance.

Image source: cashflowfrog.com

Practical Approaches to Cash Flow Analysis

Gathering financial data effectively is key to better cash flow analysis. Here’s how to put this data to work:

- Regularly review your cash flow statements.

- Generate in-depth forecasts by assessing your anticipated sales figures and expense estimates.

- Employ ratios like working capital and quick ratios to evaluate your liquidity and efficiency.

- Evaluate your cash flow patterns against industry benchmarks to measure performance and find areas for growth.

- Involve various departments to get a well-rounded view of your cash flow and make better-informed decisions.

Challenges and Limitations

One major limitation is the potential for inaccurate data due to inconsistent accounting practices or incomplete records, which can distort the analysis.

Additionally, cash flow projections often rely on assumptions that may not hold true, such as future sales or economic conditions.

In conclusion

While financial ratios are valuable for assessing cash flow, they’re just one part of the story. Pair these ratios with other data and market trends to get a well-rounded view of your company’s financial well-being.

Make gathering financial data much easier with tools like Cash Flow Frog. Sign up for a free trial today!

Spotted something? Got a story? Send a Facebook Message | A direct message on Twitter | Email: [email protected] Latest News