UK Inflation remiains at 8.7%: No relief for cost of living

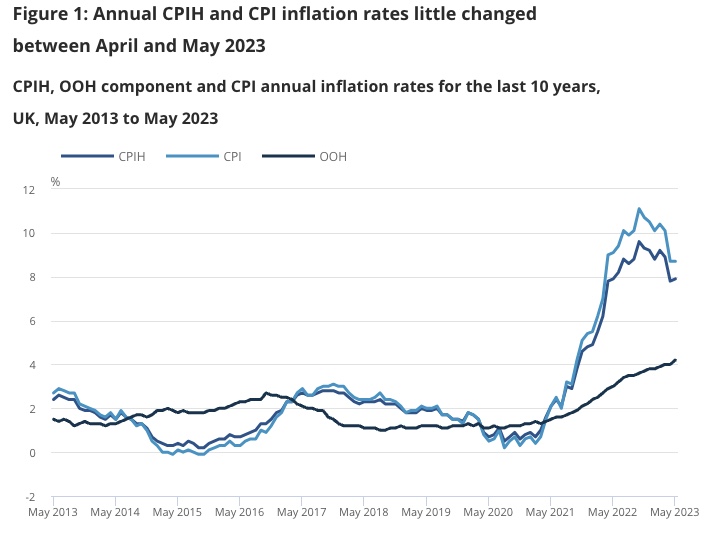

The UK’s Consumer Prices Index (CPI) remained unchanged at 8.7% in the 12 months to May 2023, according to the latest report from the Office for National Statistics (ONS).

This defies economists’ predictions, who had expected a small decrease to 8.4%.

The lack of movement in the inflation rate could prompt the Bank of England to hike interest rates to levels that haven’t been seen this century, in an attempt to end the ongoing cost of living crisis.

The ONS report highlighted that rising prices for air travel, recreational and cultural goods were the main contributors to keeping the inflation rate high.

However, falling prices for motor fuel led to the largest downward contribution to the inflation rate.

Despite the overall inflation rate remaining unchanged, prices for food and non-alcoholic drinks rose in May 2023.

However, the increase was less than in May 2022, indicating a slight easing in the rate of price rises for these items.

The report also noted a significant increase in the “core” inflation rate, which excludes volatile items such as energy and food costs.

Core inflation reached its highest rate since 1992, a clear indication of the underlying inflationary pressures in the economy.

ONS’ Chief Economist Grant Fitzner commented on the report, saying, “After last month’s fall, annual inflation was little changed in May and remains at a historically high level. The cost of airfares rose by more than a year ago and is at a higher level than usual for May. Rising prices for second-hand cars, live music events, and computer games also contributed to inflation remaining high.”

Chancellor Jeremy Hunt addressed the inflation issue, stating, “We know how much high inflation hurts families and businesses across the country, and our plan to halve the rate this year is the best way we can keep costs and interest rates down. We will not hesitate in our resolve to support the Bank of England as it seeks to squeeze inflation out of our economy, while also providing targeted support with the cost of living.”

TUC General Secretary Paul Nowak said:

“After more than a decade of pay stagnation, working people are still getting poorer every month.

“Wage rises aren’t causing inflation, real pay is still lagging far behind where it needs to be even to get living standards back to where they were over a decade ago.

“Pushing interest rates so high that the economy is driven into recession will only make the current crisis worse.

“What working people need is a credible plan for sustainable growth, to get living standards and public finances back on track.”

Spotted something? Got a story? Email: [email protected]

Latest News