Digital Inclusion: Bridging the Gap in Payment Accessibility

It is important to emphasize the significance of financial inclusion in today’s digital world. Every individual and every community now needs access to the internet so they can take part in the global modern economy. Still, millions of people—especially in underserved rural areas—are still being left out of being able to use even basic financial services.

Innovations from big companies like American Express and VISA as well as digital payment solutions are working to close this disparity and open opportunities for broader economic involvement. Platform insights such as those on Onlinecasinorank.org highlight the essential role that accessibility and convenience will play in determining the future of financial transactions.

The Importance of Digital Inclusion in Today’s Society

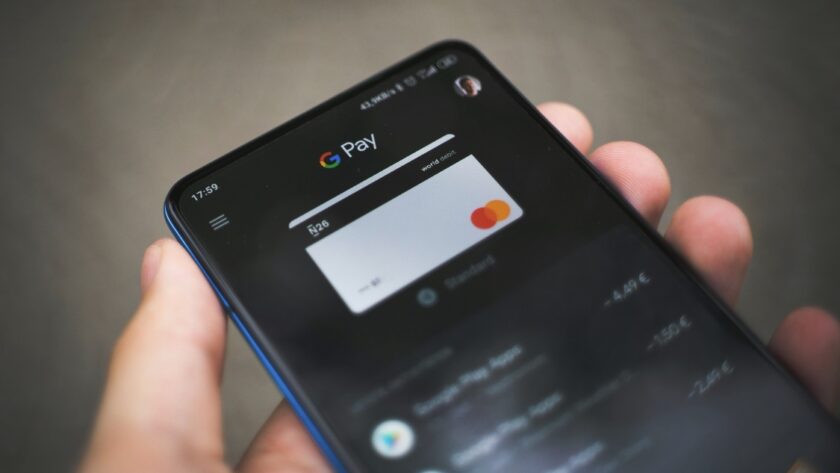

Digital inclusion is making sure everyone—especially the most underprivileged—has access to and can use digital technology with efficiency. In the financial sphere, this entails providing equitable access to digital wallets, online banking, and payment systems enabling individuals to handle their finances, make purchases, and access government services.

For areas like Deeside, where small organizations and community businesses drive local economies, strong digital payment systems are vital. By adopting digital payments and thereby minimizing dependence on cash-only transactions, farmers’ markets, artists, and small businesses will have plenty of opportunities to expand their customer base. Still, some people find these opportunities unattainable because of factors like limited technological infrastructure, financial literacy gaps, and affordability challenges.

How Payment Solutions are Closing the Gap

Companies like American Express and VISA, who operate on a global scale, are striving to overcome these obstacles by providing solutions that are specific to the needs of their customers. For example, VISA has programs meant to equip small enterprises with reasonably priced digital payment systems.

Programs in Ireland where VISA has teamed with fintech companies and local banks offer insightful analysis of how such systems might promote inclusivity. American Express has focused on providing solutions for underprivileged populations, including specialized credit alternatives and financial education tools when compared to VISA in Ireland and its extensive network.

Mobile payment systems and contactless transactions have opened the global economy to millions of people who were previously unable to participate, thanks to the innovations brought about by these firms. This is especially true in emerging nations. These payment providers are enabling communities all around to embrace the advantages of digital inclusion by building widely accepted, easy to use platforms.

Lessons from Digital Accessibility Efforts

It is becoming more apparent that inclusion needs to extend beyond technological boundaries as financial technologies progress. Ensuring that digital tools reach those who most need them depends on strong connections with governments, charities, and enterprises. Onlinecasinorank.org and other platforms stress the need for user-friendly payment systems with security, transparency, and accessibility emphasized. These ideas are applicable in many contexts, including brick-and-mortar stores, online marketplaces, and small local businesses.

These lessons are especially important in areas like Deeside, where the community is strongly linked to its identity. More than just a means of exchanging money, accessible payment systems build community bonds, promote entrepreneurship, and make the economy more resilient. Deeside’s companies can make sure nobody falls behind the digital revolution by giving inclusiveness the highest priority.

Building a Future of Financial Inclusion

Even though we’ve come a long way, there are still obstacles in terms of financial inclusion. Many rural communities still lack the infrastructure needed for consistent internet access—which is necessary for digital payment systems. Though becoming more mainstream, financial literacy initiatives are not always accessible and some people are still reluctant to use digital technologies. To overcome these obstacles, the public and private sectors must maintain their investment and innovation levels.

For areas like Deeside, collaborative efforts to incorporate technology into the fabric of daily life will determine the direction of financial inclusion. One way to make every local economy more open to progress is to spread the word about the benefits of digital payments and encourage businesses to accept them.

Wrapping Up

Digital inclusion is a necessity for society in today’s digital world. Companies like VISA and American Express are enabling people worldwide to engage in the digital economy by offering easily available, user-friendly payment options.

Adopting these ideas can help areas like Deeside open the path for a better, more inclusive economic future. Ensuring everyone has the tools to succeed will remain a vital objective as the digital revolution unfolds. This success is possible only through cooperation and shared commitment.

Spotted something? Got a story? Email: [email protected]

Latest News