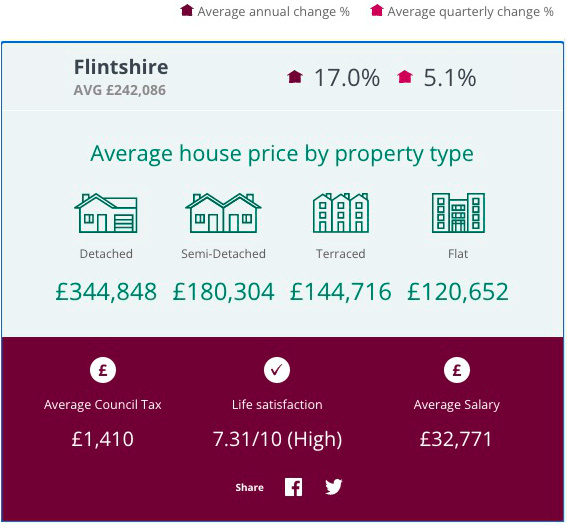

Average price of a home in Flintshire hits new high, up 17% in past year

The average price of a home in Flintshire has hit a new record high exceeding the £240,000 mark for the first time.

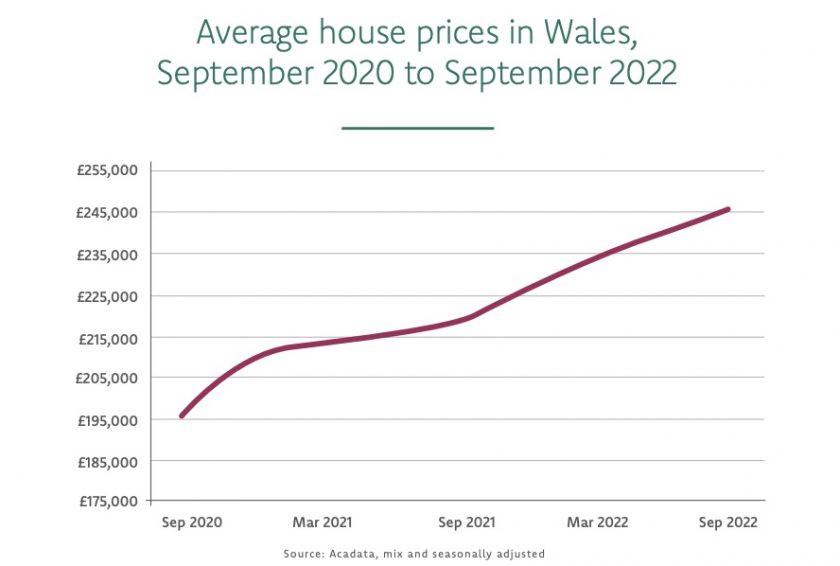

There was continued price growth across Wales in the third quarter (July to Sept) with average prices in up by 12.4% annually, and 2.2% quarterly.

The average price of a home in Wales now stands at £245,893, according to the Principality Building Society.

Property prices are up in all local authority areas compared with a year earlier.

Led by the Vale of Glamorgan and Flintshire, 16 authorities report annual price increases of more than 10% – that is above the current rate of consumer price inflation.

Flintshire has seen house prices rise by 17% in the past 12 months, the second-highest annual change in Wales, only Vale of Glamorgan was higher at 17.4%.

House prices grew by 5.1% in Flintshire during quarter three, the average price in the county now stands at £242,086, again only Vale of Glamorgan was higher at 5.5%.

Elsewhere, price increases in several authorities – Gwynedd, Anglesey, Conwy in North Wales and the urban centres of Newport, Wrexham and Cardiff – are more modest, “these authorities will be experiencing modest drops in real terms, set against overall price inflation.”

“Despite the continuing strong pattern of annual price rises and new record highs, the quarterly picture is more mixed, with only 13 local authorities reporting quarterly increases of which several of these negligible.” Principality has said.

Shaun Middleton, Head of Distribution at Principality Building Society said: “It is slightly strange talking about house prices in Wales reaching new peaks when so much has happened at the end of the third quarter with the UK government minibudget and continued cost of living pressures.”

“Transaction levels remained relatively strong over the third quarter, helped in part by buyers wishing to complete their house purchase with the attractive mortgage deals they had previously secured.”

He said: “With interest rates surging higher, meaning repayments on mortgages will become much more costly per month, the market faces significant challenges in the immediate future.”

“Even though the Welsh Government has increased the Land Transaction Tax threshold from £180,000 to £225,000 in a bid to support first time buyers and those wishing to move homes, affordability will come under considerable pressure, which could mean that purchasing demand will reduce.”

Shaun said “It must be remembered that higher energy costs and general rises in cost of living are increasing overall household expenditure which will have to be factored into mortgage lenders calculations when assessing borrowers’ ability to repay.”

“This will reduce the amount lenders are able to loan to the borrower, make it even harder for first time buyers to obtain a mortgage and will also mean many people will be unable to obtain the bigger mortgage they need to move to their next home.”

“For this reason, many are predicting a decline in house price inflation. However, there are many unknowns at this stage.”

“A lot does depend on any potential government interventions, as well as, of course, on the actions of the Bank of England with regards to future rate rises.”

“By the time of the fourth-quarter report, there will hopefully be more clarity on what the outlook is for property prices.” He added.

Spotted something? Got a story? Email: [email protected]

Latest News