UK inflation holds steady at 6.7%: food prices dip while fuel costs surge

The UK’s rate of inflation has maintained its position at 6.7% for September, echoing the rate recorded in August, as per the latest data from the Office for National Statistics (ONS).

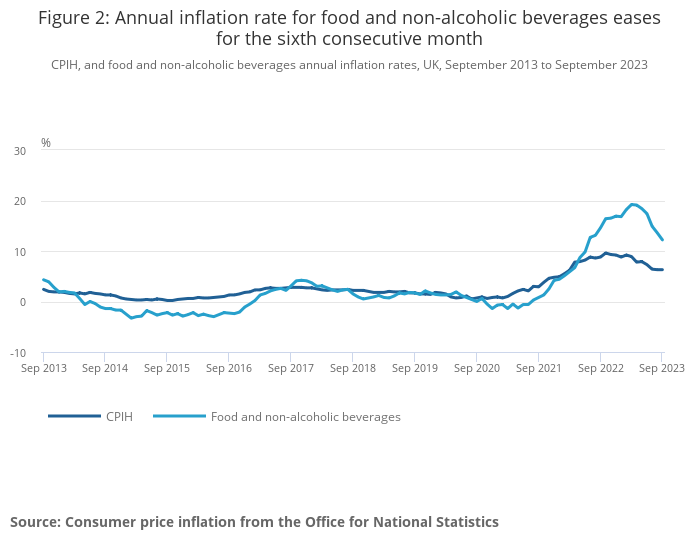

Delving into the numbers, the most significant drop contributing to the monthly change in CPI annual rates was seen in food and non-alcoholic beverages.

The biggest drops in price were in milk, cheese, eggs, and drinks like juices and soft drinks.

Cheese prices fell the most, going down by 3.3% from August to September.

The only food that got more expensive was fish, mainly frozen prawns.

Their yearly price rise was 8.7% by September, which is higher than the 6.8% in August.

The average price of petrol rose by 5.1 pence per litre between August and September 2023 to stand at 153.6 pence per litre in September 2023.

Last year, prices fell by 8.7 pence per litre to stand at 166.5 pence per litre in September 2022. Similarly, diesel prices rose by 6.3 pence per litre this year to stand at 157.4 pence per litre.

Last year, they fell by 5 pence per litre to stand at 181.6 pence per litre in September 2022.

Grant Fitzner, Chief Economist at the ONS:

“After last month’s fall, annual inflation was unchanged in September. Food and non-alcoholic drinks prices eased again across a range of items with the cost of household appliances and airfares also falling this month.”

“These were offset by rising prices for motor fuels and the cost of hotel stays. The annual rate of core inflation has slowed again this month, driven by a slowdown in the cost of many goods though services prices did rise a little this month.”

The chancellor, Jeremy Hunt, said: “As we have seen across other G7 countries, inflation doesn’t always decrease uniformly, but if we remain committed to our strategy, we anticipate it continuing to decline this year.”

“Today’s update underscores the importance of this approach to alleviate the strain on families and businesses.”

The latest inflation data is particularly important as it is the basis for uprating working-age benefits next April.

James Smith, Research Director at the Resolution Foundation, said:

“Progress on falling inflation has stalled, for one month at least. It should fall sharply next month to below 5 per cent next, as energy prices fall for most people.

“The latest inflation data tells us about the recent past and also shapes cost-of-living pressures on low and middle income households next year, as it normally used to increase benefits in April.

“Should the government choose not to do this, as it has done seven times since 2010, in order to save money, nine million families across Britain will pay a heavy price.

“Families who receive benefits would see their incomes fall by £460 on average, while many low-income families with kids face much higher income losses, rising to £1,200 for a low income couple with two children.”

Sue Davies, Which? Head of Food Policy, commented: “While it’s encouraging that overall inflation is moderating, supermarket prices remain markedly higher than they were twelve months ago.”

“The cost of certain everyday items has increased faster than the overall rate of food inflation, as evidenced by the Which? monthly tracker.”

“To mitigate the significant burden on consumers – particularly families and those with limited budgets – supermarkets could offer reasonably priced essential items in high-priced convenience stores nationwide. Which? studies indicate that these stores seldom stock the most affordable products.”

Spotted something? Got a story? Email: [email protected]

Latest News