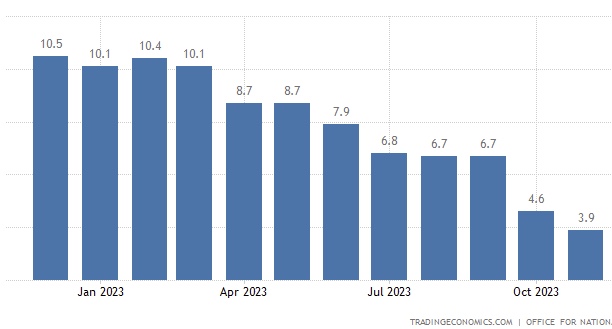

UK Inflation eases to 3.9%, offering some relief to households

The UK inflation rate has fallen to 3.9% in the year to November the lowest rate since September 2021.

The fall in inflation, as reported by the Office for National Statistics (ONS), have surpassed analysts’ expectations who had predicted a rate of around 4.4%.

The decline in inflation rate is particularly noteworthy considering the recent peak of 11.1% in October 2022, the highest in over four decades, primarily driven by soaring energy and food prices.

The ONS report indicates that the decrease in the annual inflation rates was influenced by reductions across several divisions, with transport, recreation and culture, and food and non-alcoholic beverages leading the way.

Notably, there were no divisions with significant upward effects to offset this decline.

In the year to November 2023:

▪️ Consumer Prices Index including owner occupiers’ housing costs rose by 4.2%, down from 4.7% in October

▪️ Consumer Prices Index (CPI) rose by 3.9%, down from 4.6% in October

➡️ https://t.co/RZCLXrRVqp pic.twitter.com/NA7C8hnrHY

— Office for National Statistics (ONS) (@ONS) December 20, 2023

In the transport sector, prices fell by 1.4% in the year to November 2023, a stark contrast to the 0.5% rise in October.

This reduction in transport costs marks a reversal from the trend seen earlier in the year.

Similarly, food and non-alcoholic beverage prices decreased, with bread and cereals experiencing a 0.8% drop between October and November, compared to a 1.9% increase in the same period last year.

Grant Fitzner, Chief Economist at the ONS, remarked on the findings: “Inflation eased again to its lowest annual rate for over two years, but prices remain substantially above what they were before the invasion of Ukraine.”

“The biggest driver for this month’s fall was a decrease in fuel prices after an increase at the same time last year.”

“Food prices also pulled down inflation, as they rose much more slowly than this time last year. There was also a price drop for a range of household goods and the cost of second-hand cars.”

While the easing of inflation offers some relief to households, it’s crucial to recognise that prices are still significantly higher than pre-geopolitical tension levels.

The ONS report also notes that factory gate prices have remained relatively stable over the past year, and the cost of raw materials and fuel for producers has been negative for six consecutive months.

Chancellor Jeremy Hunt commented on the situation, saying, “we are starting to remove inflationary pressures from the economy,” adding that the government will continue to prioritize measures that help with cost of living pressures.

However, TUC General Secretary Paul Nowak provided a more cautious perspective: “The Conservatives have delivered 13 years of dismal growth and living standards.

“Today’s inflation figures will provide scant relief for hard-pressed families. Prices are still going up – just a bit more slowly. Household budgets remain under immense pressure. And many families will struggle with the cost of Christmas with food and energy bills sky-high. Britain cannot afford the Tories.”

Spotted something? Got a story? Email: [email protected]

Latest News