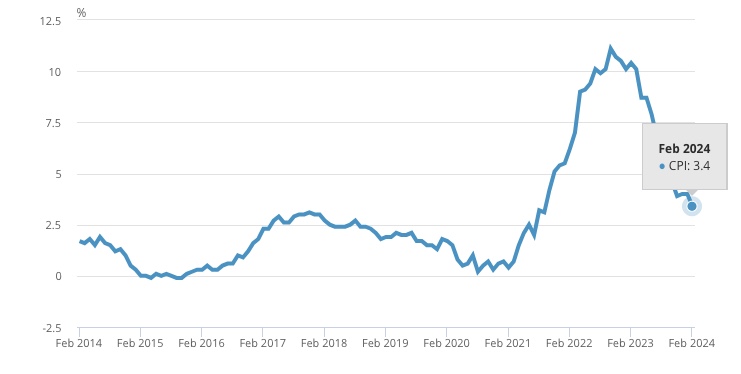

UK inflation drops to 3.4%, hitting a two-year low

Inflation for February has been reported at 3.4%, marking a decrease from the previous month’s rate of 4%.

The figures from the Office for National Statistics (ONS) exceeded economists’ expectations, which had anticipated a drop to 3.5%.

The reduction in inflation was primarily influenced by lower food prices, particularly notable in the sectors of bread and cereals, which saw the smallest price increase in over two years.

February’s data indicated a mere 0.3% rise in prices for these items compared to a 2.3% increase during the same period last year.

This brought the annual rate for bread and cereals down to 6.0%, the lowest since March 2022.

The drop in inflation signifies not a reduction in prices but a deceleration in the rate at which they are increasing.

This change is particularly beneficial for lower-income households, which dedicate a larger portion of their income to food and have been significantly affected by the ongoing cost of living crisis.

While food prices were the main contributors to the decline in inflation, the effect was somewhat balanced by increases in petrol prices and rental costs.

However, the overall trend indicates a slowing pace in price rises, offering a glimmer of hope for an easing cost of living crisis.

[Image: ONS]

ONS Chief Economist Grant Fitzner said: “Inflation eased in February to its lowest rate for nearly two and half years.”

“Food prices were the main driver of the fall, with prices almost unchanged this year compared to a large rise last year, while restaurant and café price rises also slowed.”

“These falls were only partially offset by price rises at the pump and a further increase in rental costs. ”

James Smith, Research Director at the Resolution Foundation, emphasised the significance of this development, stating:“The fastest fall in inflation for almost half a century will be welcome news for households – with food inflation falling to its lowest rate in two years – and the Bank of England, as inflation looks on track to hit its 2 per cent target in April.”

“Services inflation also continues to fall which, coupled with falling nominal wage growth, should give monetary policy makers more confidence that wage pressures on inflation are starting to ease.”

Spotted something? Got a story? Email: [email protected]

Latest News