New first time buyer paying nearly £200 more a month than a year ago

First-time buyers are paying an average of nearly £200 extra a month compared to a year ago, according to UK property website Rightmove.

The increase is being driven by new record average asking prices and higher mortgage rates,

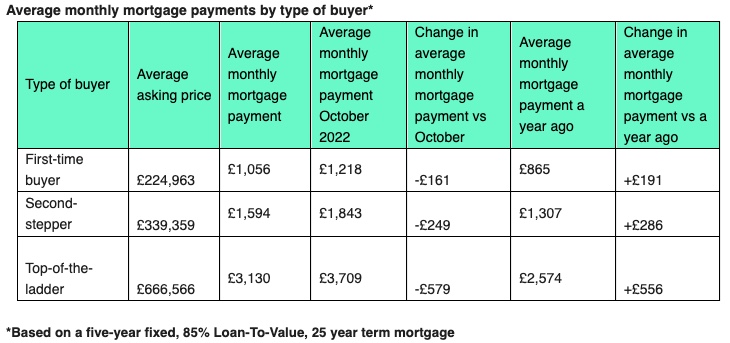

First-time buyers with a 15% deposit now pay an average of £1,056 per month, up from £865 last year.

However, this figure is significantly lower than the £1,218 per month at the peak of rates in October.

The analysis is based on the average asking price for a typical first-time buyer property (two bedrooms or fewer) and the average rate for a five-year fixed, 85% Loan-To-Value (LTV) mortgage spread over 25 years.

Currently, the average rate for a five-year fixed mortgage with a 15% deposit is 4.44%, down from 5.89% in October but up from 2.76% at this time last year.

The average asking price for a first-time buyer property has reached a new record of £224,963.

Despite economic challenges, determined first-time buyers are striving to get onto the property ladder.

Buyer demand in the first-time buyer sector is currently 11% higher than in 2019, holding up strongly against pre-pandemic levels.

Stabilising mortgage rates and a frenetic rental market are driving this determination among first-time buyers.

The average asking rent for a first-time buyer property is now £1,120 per calendar month, an 11% increase compared to last year.

The average monthly mortgage payment for home-movers is beginning to steady as mortgage rates settle.

Purchasing a property at the current average asking price of £366,247 with a 5-year fixed, 15% deposit mortgage would now cost £1,720 per month.

This figure compares to £2,012 per month in October after the mini-budget and £1,792 per month in January.

Rightmove’s mortgage expert, Matt Smith, said that the new record price and higher mortgage rates make it challenging for first-time buyers.

However, buyer demand in this sector is higher than in the last more normal market of 2019.

Smith advises would-be buyers to assess their individual circumstances and consider their affordability based on current rates, weighing up the potential cost of waiting or paying rent for longer.

Spotted something? Got a story? Email: [email protected]

Latest News