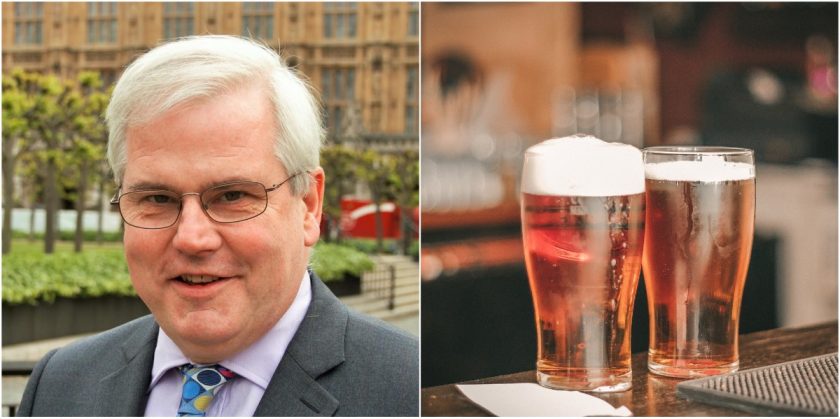

Alyn & Deeside MP Mark Tami calls on Chancellor to support independent local pubs

The MP for Alyn & Deeside, Mark Tami, has written to the Chancellor of the Exchequer calling on him to support pubs.

The Labour MP was given a Beer Champion 2019 award by the Long Live The Local Campaign last year for his work on this issue.

The pub trade provides significant employment in Flintshire and across the UK, but is one of the most heavily taxed industries.

Recent years have seen the number of pubs declining, and although that trend has stagnated this seems to be because of a growth in large chain pubs whilst small independent locals continue to shut.

I have written to the Chancellor, @sajidjavid, about the taxation on pubs and how the Government could choose to help independent locals. pic.twitter.com/99R9itTkG4

— Mark Tami MP (@MarkTamiMP) January 22, 2020

In his letter to the Chancellor, Mr Tami says: “I am writing to you regarding the level of taxation which pubs are subject to.

“As you know, there has been a long-term trend of pubs closing, and whilst this trend appears to have stagnated a closer analysis suggests that smaller independent pubs which represent the heart of many communities are continuing to close and that this difference is being made up by larger town and city centre chain pubs.

The pub is a vital part of British life and in some communities in my constituency it is the last remaining community amenity. More broadly the benefit of pubs to the Exchequer is well established. Visiting a pub is often a must-do for visitors to the UK and pubs attract attract more tourists each year than Buckingham Palace.

Given the vital contribution pubs make to the UK, I wonder whether the Treasury would consider introducing a preferential rate of beer duty for pubs relative to supermarkets and off-licences, allowing them to thrive.

I would also be interested to hear your views on the Welsh Government’s High Street and Retail Rates Relief scheme’s success in supporting pubs.”

Earlier this month, the Welsh government announced the extension of its high street and retail rates relief scheme for 2020-21, providing support for businesses in Wales with a rateable value of up to £50,000.

The scheme will provide support to more than 15,000 small and medium-sized businesses in 2020-21.

As well as supporting retailers on the high street, the scheme will continue to support businesses in other locations.

Ratepayers benefiting from the relief include those with occupied retail premises such as shops, restaurants, cafés, pubs and wine bars

Spotted something? Got a story? Send a Facebook Message | A direct message on Twitter | Email: News@Deeside.com

Latest News