Nearly half of UK consumers plan to cut back this Christmas, Which? finds

With the economy heading into recession, Which? research shows that nearly half of (46%) consumers say they plan to cut back this festive season due to the rising cost of living – as the numbers missing payments remain alarmingly high.

The latest findings from Which?’s consumer insight tracker show that millions of people across the country will be spending less this Christmas due to financial pressures. The consumer champion’s research has also found that the number of households missing vital mortgage, rent, bill and credit card payments and cutting back on essentials is still worryingly high.

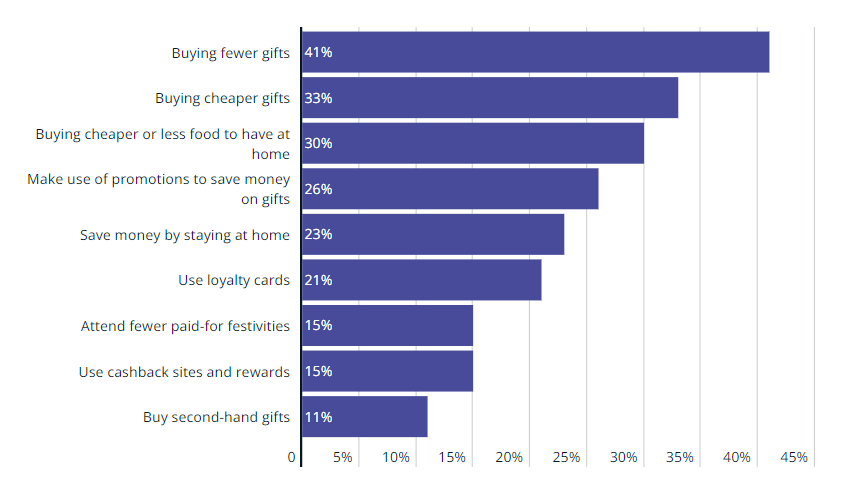

Nearly half (46%) of UK consumers plan to cut costs this Christmas. Gifts are one of the ways people plan to spend less. Four in ten (41%) consumers told us that they plan to cut back by buying fewer gifts this year, whilst a third (33%) said they would buy cheaper gifts, and a quarter (26%) said they would take advantage of promotions or discounts to save money on gifts.

Consumers’ money-saving tactics

The money saving tactics went beyond gift buying, with three in 10 (30%) consumers saying they would buy cheaper or less food and drink to have at home over the Christmas period, and a quarter (23%) saying they would simply stay at home more to save money.

Many households said the rising cost of living was the reason for reduced spending. A 21-year-old woman from the South West said: “The cost of living is ridiculous. I can barely afford to support myself… why would I waste money on Christmas when I can use [it] to survive?”

Some have made a conscious decision as a family to spend less money this year. A 27-year-old woman from the East Midlands said: “I have less spare money this Christmas than I would normally have. I have had to pay a number of large bills in the last few weeks…I think most of my family and those I celebrate Christmas with are in the same boat as well so it’s a bit of an agreement that Christmas this year will be quieter and less frivolous.”

Lisa-Anne Campbell, 46, from Hertfordshire has had to drastically cut back on her Christmas spend this year. Rising energy bills and food costs means that buying presents for friends and the wider family circle is no longer viable. Lisa-Anne has been putting money aside for the last few months so that her two young children do not go without.

Doing the Christmas food shop is also a worry. Lisa-Anne has epilepsy and no longer drives. Her nearest supermarket within walking distance is a smaller convenience store. It is often a struggle to find any products from budget ranges.

She told Which?: “Costs are astronomical. I don’t have the heating on to save as much money as I can. I’m only buying Christmas presents for my two children this year.

“I have also cut back on Christmas costs by buying second-hand gifts, refurbished electronics, and shopping during the Black Friday sales.”

Even among the one in 10 (8%) people who said they would be spending more – in many cases, this was driven by increases in prices, and not a conscious decision to splash out over the festive season.

A 59-year-old man from Scotland said: “I’m spending more because the cost of everything has increased. From prices of items to postage. I’m not buying anymore than previous years either but it’s still more expensive.”

Which?’s consumer insight tracker showed financial pressures are high this November. An estimated 2.2 million households said they missed or defaulted on a vital payment – such as a mortgage, rent, credit card or bill payment – in the last month. This is an increase from the estimated 1.8 million who missed payments in November 2021, demonstrating that many who were coping financially last year are now struggling to make ends meet.

Just under six in ten (57%) people made at least one financial adjustment – such as cutting back on essentials, selling items or dipping into savings – in the last month to cover essential spending. This equates to an estimated 16 million households.

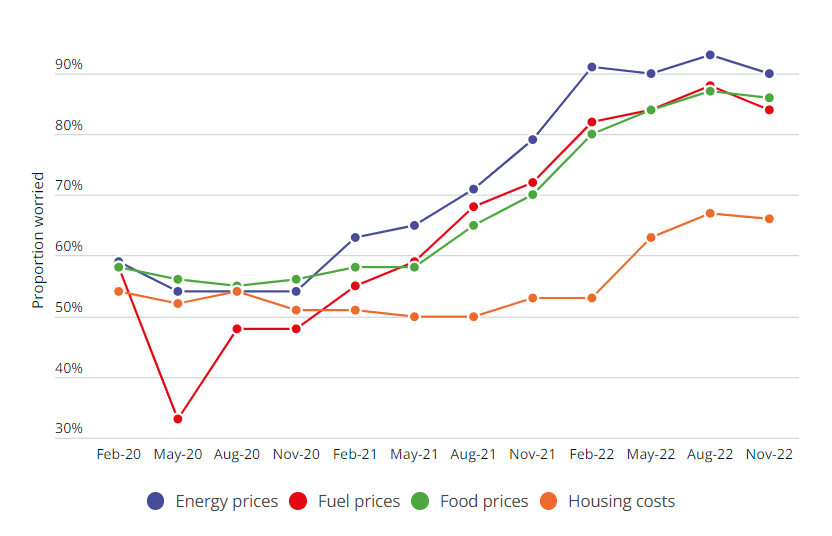

Consumers’ biggest financial worries

This is a significant increase from the almost half (46%) making financial adjustments this time last year, but lower than the peak of two-thirds (65%) making adjustments in September 2022.

Nine in ten (90%) consumers are worried about energy prices, whilst nearly nine in 10 (86%) are worried about food prices, around eight in 10 (84%) about fuel prices and two-thirds (66%) about housing costs.

For each concern, the proportion worried has increased by more than ten percentage points compared November 2021 – with worry about food seeing the biggest increase of 16 percentage points.

With the UK heading into recession, colder weather setting in and the energy price guarantee increasing in April, consumers will only face further financial pressures in the New Year.

Businesses are also facing pressure due to soaring inflation. But there is a lot they can do to help make consumers’ lives better and more affordable in 2023 and beyond. Which? has launched a campaign which identifies a range of specific actions essential businesses – such as supermarkets, energy and telecom providers – can and should take to support consumers.

The consumer champion’s calls to business aim to ensure that people have access to the best value products and services across the UK – for example, supermarkets should increase availability of own-brand budget ranges in supermarkets, particularly in low income areas. Which? is also calling on companies to provide transparent pricing for groceries and essential services and asking telecoms and energy firms to make sure their customer service departments are properly resourced to cope with an expected surge in demand.

Rocio Concha, Which? Director of Policy and Advocacy, said:

“Our research has found that millions of households up and down the country are planning to cut back this Christmas due to the rising cost of living.

“With prices only predicted to keep rising in 2023, Which? is calling on businesses to do all they can to support their customers through this extraordinary cost of living crisis. While government intervention is necessary, we also believe businesses across essential services can and should do more to help.

“In the lead up to Christmas, supermarkets in particular can play their part in helping their customers navigate the tough months ahead. Budget lines for healthy and affordable essential items need to be widely available across their stores and supermarkets should ensure shoppers can easily compare the price of products to get the best value. Promotions should be targeted at supporting those most in need.”

[images: Which?]

Spotted something? Got a story? Email: [email protected]

Latest News