Budget 2017: Two north Wales specific announcements and some ‘new’ money for the Welsh Government

There were two north Wales specific announcements in Chancellor Phillip Hammonds Autumn Budget today.

He said the government is to consider proposals to improve journey times on the Wrexham – Bidston route and provide necessary funding to develop the business case.

“Looks like we’re being listened to” tweeted the Wrexham-Bidston Rail Users’ Association.

The Chancellor also said; “The government will begin formal negotiations towards a North Wales growth deal“

Delyn MP David Hanson wasn’t impressed with that lack of detail from Mr Hammond who has promised action on a growth deal for north Wales three times.

Mr Hanson said;

“Three times the Chancellor has promised a North Wales Growth Deal and each time he has failed to deliver. A growth deal would mean extra financial support for businesses and communities. It would also mean improved investment into our roads and rail. Without this deal we will lag behind the rest of the country undermining the entrepreneurial drive of residents.

“The Growth Deal is crucial for North Wales. Labour MPs, AMs and Councillors have been pressing for its implementation along with the Welsh Labour Government. Even if the process does finally start the Chancellor has not made clear what form the Growth Deal will take.

“The UK Government has dragged its feet on the Growth Deal for too long. They have shown their true values and it does not include prosperity for North Wales. I will continue to work with my North Wales colleagues to ensure that this deal becomes reality sooner rather than later.”

The Chancellor also announced what was claimed to be £1.2bn of ‘new’ money for Wales.

However, this doesn’t take into account that much of this will have to be repaid by the Welsh Assembly Government to the UK Treasury and will come with restrictions on how it can be spent.

Around £1bn of the ‘new’ money will be capital funding for Wales between 2017-18 and 2020-21 – but more than half of this must be repaid to the UK Treasury, £215m for the period 2017-18 to 2019-20 will be in revenue funding.

Welsh Government Finance Secretary Mark Drakeford said:

“While these small increases in the resources available to Wales are to be welcomed as they will help support our priorities, this additional funding will do little to ease the pressures on frontline public services, which have been struggling to cope as a result of the successive cuts to our budget we have experienced since 2010-11.

“Even with this additional funding, the Welsh Government’s budget will be 5% lower in real terms in 2019-20 than it was in 2010-11.

As a result of the measures the Chancellor announced today the funding Wales receives from the block grant will increase.

But more than half of this increase is in the form of funding which must be paid back to the UK Treasury.

£650m of the additional capital funding is in the form of financial transactions – this is a form of capital funding which must be repaid to the Treasury and there are tight restrictions on what it can be spent on.”

The Finance Secretary said the budget was also a missed opportunity to provide additional investment in infrastructure to support the economy during this period of uncertainty.

Autumn Budget Highlights 2017:

Abolishing stamp duty land tax (SDLT) on homes under £300,000 for first-time buyers from 22 November

95% of first-time buyers who pay stamp duty will benefit.

First-time buyers of homes worth between £300,000 and £500,000 will not pay stamp duty on the first £300,000. They will pay the normal rates of stamp duty on the price above that. This will save £1,660 on the average first-time buyer property.

80% of people buying their first home will pay no stamp duty.

There will be no relief for those buying properties over £500,000.

It’s a concession that will run out in Wales next April when stamp duty is replaced by the new Welsh Land Transaction Tax, unless the Welsh Government announces a similar concession. The rates already announced would apply to all purchases over £150,000.

The tax-free personal allowance will rise with inflation to £11,850 from April 2018

The personal allowance – the amount you earn before you start paying income tax – will rise from £11,500 to £11,850. This means that in 2018-19, a typical taxpayer will pay £1,075 less income tax than in 2010-11.

Fuel duty will remain frozen for an eighth year

In 2018, fuel duty will remain frozen for the eighth year in a row, saving drivers £160 a year on average.

Duty on beer, wine, cider and spirits will be frozen

The cost of a pint of beer or cider will be 1p lower than if duty had risen by inflation. The cost of a typical bottle of wine will be 6p cheaper.

Cheap, high-strength cider will be subject to a new band of duty.

Duty on tobacco will rise

The duty on cigarettes will increase by 2% above inflation. Hand-rolling tobacco duty will increase by 3% above inflation.

Households applying for Universal Credit will get more upfront support

Households in need who qualify for Universal Credit will be able to access a month’s worth of support within five days, via an interest-free advance, from January 2018. This can be repaid over 12 months.

Claimants will be eligible for Universal Credit from the day they apply, rather than after seven days. Housing Benefit will continue to be paid for two weeks after a Universal Credit claim.

Low-income households in areas where private rents have been rising fastest will receive an extra £280 on average in Housing Benefit or Universal Credit.

Electric and driverless cars

The UK will set out rules so that self-driving cars can be tested without a safety operator.

An extra £100 million will go towards helping people buy battery electric cars. The government will also make sure all new homes are built with the right cables for electric car charge points.

Reducing single-use plastics waste

The government will seek views on reducing single-use plastics waste through the tax system and charges. Disposable plastics like coffee cups, toothpaste tubes and polystyrene takeaway boxes damage our environment.

This follows the success of the 5p carrier bag charge, which has reduced the use of plastic bags by 80% in the last two years.

The National Living Wage and the National Minimum Wage will increase from April 2018

The National Living Wage for those aged 25 and over will increase from £7.50 per hour to £7.83 per hour from April 2018. Over 2 million people are expected to benefit. For a full-time worker, it represents a pay rise of over £600 a year.

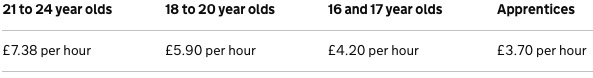

The National Minimum Wage will also increase:

Spotted something? Got a story? Email: [email protected]

Latest News