HMRC urges 5.7m people to file tax returns before deadline

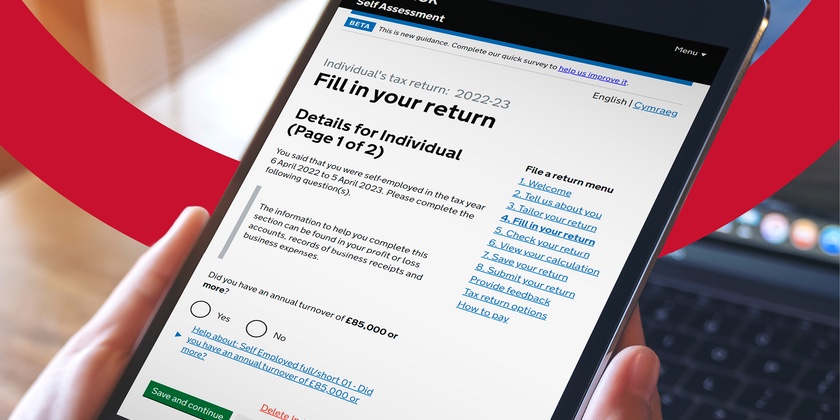

As the January 31st deadline for Self Assessment tax returns rapidly approaches, HM Revenue and Customs (HMRC) is sending a clear message to nearly 5.7 million customers in the UK: the time to file is now.

In an urgent call, HMRC is stressing the importance of meeting the deadline to avoid potential fines and penalties.

HMRC’s latest data reveals that almost 6.5 million customers have already completed their tax returns, with an impressive 49,317 filing over the New Year holiday.

The surge in early filings, including 25,593 submissions on New Year’s Eve and 23,724 on New Year’s Day, indicates a proactive approach by many taxpayers.

Myrtle Lloyd, HMRC’s Director General for Customer Services, emphasises the urgency, stating, “The clock is ticking for those customers yet to file their tax return. Don’t put it off, kick start the new year by sorting your Self Assessment. Go to GOV.UK and search ‘Self Assessment’ to get started today.”

HMRC says it is providing extensive support to help taxpayers meet their obligations.

Online resources include a series of video tutorials on YouTube and helpful guides on GOV.UK. Furthermore, the HMRC app offers a secure and convenient way to pay tax bills.

For those unable to pay in full, HMRC offers guidance and the possibility of arranging an affordable payment plan, known as Time to Pay, for amounts less than £30,000.

This can be arranged online via GOV.UK, searching for “HMRC payment plan.”

The penalties for missing the deadline are steep, starting with an initial £100 fixed penalty.

This increases to daily penalties of £10 after three months, and further penalties at six and twelve months, including 5% of the tax due or £300, whichever is greater.

Late payments also attract additional penalties and interest.

Taxpayers are also warned about the risk of scams and are advised never to share their HMRC login details. Official HMRC scams advice is available on GOV.UK.

Missing the January 31st deadline can result in significant fines, escalating for each month the tax return is delayed.

HMRC is encouraging everyone to take action now to avoid these penalties and ensure compliance with tax obligations.

Spotted something? Got a story? Email: [email protected]

Latest News