HMRC issues scam warning ahead of Self Assessment deadline

The HMRC is urging Self Assessment filers to be alert to fraudsters as the January 31 deadline to submit their tax return approaches.

In the last year alone nearly 150,000 scam referrals were made to HM Revenue & Customs – a rise in 16.7 per cent.

144,298 of these were received between November 2023 and October 2024, up from 123,596 in the previous 12-month period.

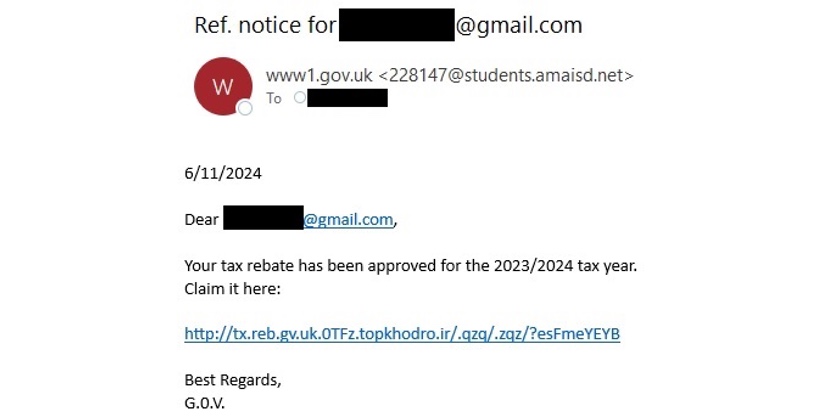

According to the HMRC around half of all scam reports (71,832) in the last year were fake tax rebate claims.

With the January 31 2025 deadline approaching for Self Assessment deadline, fraudsters are targeting people with offers of tax refunds or demanding payment of tax to get hold of personal information and banking detail

If someone receives communication claiming to be from HMRC that asks for their personal information or is offering a tax rebate, check the advice on GOV.UK to help identify if it is scam activity.

HMRC will never leave voicemails threatening legal action or arrest, or ask for personal or financial information over text message – only fraudsters and criminals will do that.

Kelly Paterson, Chief Security Officer at HMRC, said: “With millions of people filing their Self Assessment return before January’s deadline, we’re warning everyone to be wary of emails promising tax refunds.

“Being vigilant helps you spot potential scams. And reporting anything suspicious helps us stop criminal activity and to protect you and others who could have received similar bogus communication.

“Our advice remains unchanged. Don’t rush into anything, take your time and check ‘HMRC scams advice’ on GOV.UK.”

HMRC will not contact you by email, text, or phone to announce a refund or ask you to request one.

Anyone who is due a refund from HMRC can claim it via their online HMRC account or the free and secure HMRC app.

You can report any phishing attempts to HMRC by:

- forwarding emails to [email protected]

- reporting tax scam phone calls to HMRC on GOV.UK

- forwarding suspicious texts claiming to be from HMRC to 60599

Spotted something? Got a story? Email: [email protected]

Latest News