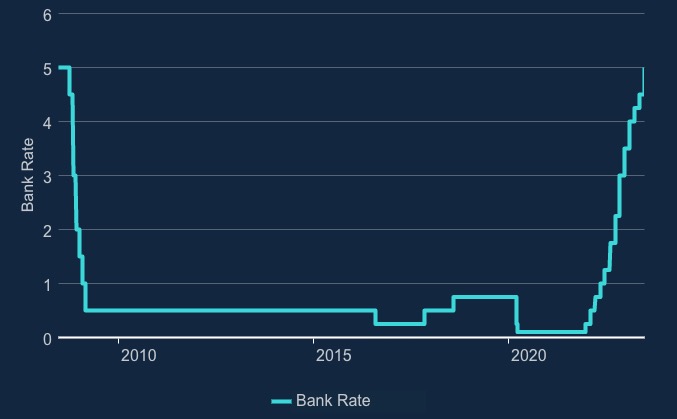

Bank of England raises interest rates to 5% as inflation is 8.7%

The Bank of England’s Monetary Policy Committee (MPC) has again voted to raise the base interest rate – this time by +0.5% , the highest level since 2008.

Back in December 2021 the base rate was at 0.1% and has seen a rise since.

The Bank Rate / Interest Rate

The ‘Bank Rate’ is the single most important interest rate in the UK. In the news, it’s sometimes called the ‘Bank of England base rate’ or even just ‘the interest rate’.

How Bank Rate affects you partly depends on if you are borrowing or saving money.

If rates fall and you have a loan or mortgage, your interest payments may get cheaper. And, if you have savings, you may be paid less interest. If interest rates fall, it’s cheaper for households and businesses to increase the amount they borrow but it’s less rewarding to save.

Lower rates also tend to increase the value of wealth, such as people’s pensions or housing, compared to what they would have been.

Bank of England explanation

Twelve-month CPI inflation fell from 10.1% in March to 8.7% in April and remained at that rate in May. This is 0.3 percentage points higher than expected in the May Report. Services CPI inflation rose to 7.4% in May, 0.5 percentage points stronger than expected at the time of the May Report, while core goods price inflation has also been much stronger than projected. In general, news in the latter component is less likely to imply persistent inflationary pressures.

Inflation

Inflation is a measure of how much the prices of goods (such as food or televisions) and services (such as haircuts or train tickets) have gone up over time.

Usually people measure inflation by comparing the cost of things today with how much they cost a year ago. The average increase in prices is known as the inflation rate.

So if inflation is 3%, it means prices are 3% higher (on average) than they were a year ago. For example, if a loaf of bread cost £1 a year ago and now it’s £1.03 then its price has risen by 3%.

Ele Clark, Which? Money Senior Editor, said:

“This further rate rise could help to curb inflation, but it will also push up housing costs for millions of people across the country.

“Mortgage holders coming to the end of their fixed term, and those on tracker or standard variable rates, will be most affected by higher repayments. Anyone worried about paying their mortgage should speak to their lender, as they are obliged to offer support. Help could include payment holidays, interest-only payments or extending the term of your mortgage. Unplanned missed payments can harm your credit rating, so it’s best to speak to your lender and agree on a way forward before it comes to that.

“It’s vital that the financial regulator closely monitors whether banks are doing a good job of helping mortgage-holders during this difficult time and acts quickly if they are falling short.

“It won’t be lost on savers that some banks have been very quick to increase mortgage rates, but they should not treat mortgage holders and savers differently by hiking rates at different times. The FCA should not hesitate to step in should banks continue to treat customers in this way.”

Spotted something? Got a story? Email: [email protected]

Latest News