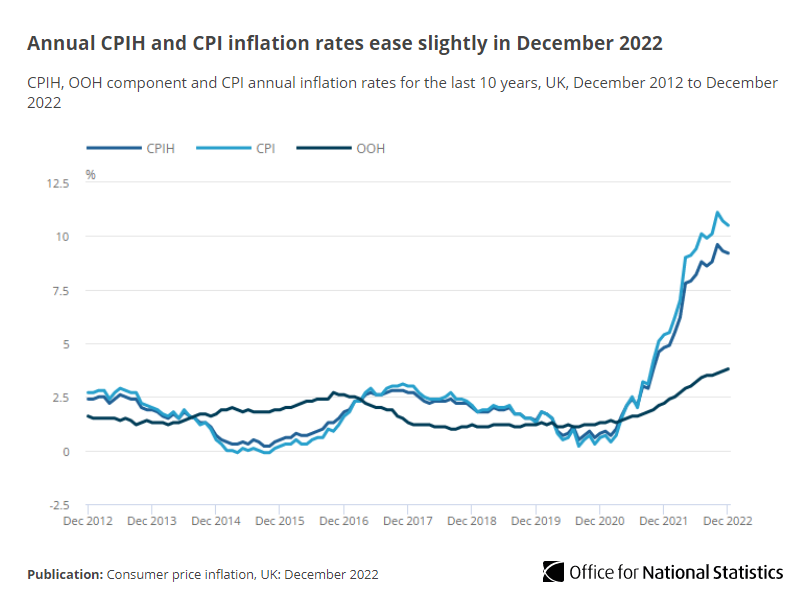

Slight dip in UK inflation rate but remains near 40 year high

Inflation in the UK has fallen to 10.5% in the 12 months to December, down from 10.7% in November and moves further away from the 41-year high of 11.1% in October.

Despite this dip, prices are still on the rise, just not as sharply as before.

The Bank of England’s target inflation rate is 2%, meaning that the current rate is still five times higher.

This could potentially lead to further interest rate hikes in the future.

The main drivers behind this inflation spike were housing and household services, particularly electricity, gas, and other fuels, as well as food and non-alcoholic beverages.

Transport, particularly motor fuels, clothing and footwear, and recreation and culture, saw the largest downward contributions to the change in inflation rates between November and December 2022.

However, rising prices in restaurants and hotels, and food and non-alcoholic beverages partially offset these decreases.

ONS Chief Economist Grant Fitzner said:

“Inflation eased slightly in December, although still at a very high level with overall prices rising strongly during the last year as a whole.”

“Prices at the pump fell notably in December, with the cost of clothing also dropping back slightly.”

“However, this was offset by increases for coach and air fares as well as overnight hotel accommodation. Food costs continue to spike with prices also rising in shops, cafés and restaurants.”

Spotted something? Got a story? Email: [email protected]

Latest News