Welsh rates of income tax – HMRC letters landing on Flintshire doormats this week

Tax payers in Flintshire have been receiving letters this week from Her Majesty’s Revenue and Customs.

The light thud of a brown HMRC envelope dropping onto the doormat is enough to send a cold shiver down one’s spine, but fear not, they don’t want more of your hard earned cash …. yet!

The letters are telling us that from 6 April 2019, some of the Income Tax paid by people living in Wales will be transferred straight to the Welsh Government.

For the first time, a proportion of that Income Tax will go directly to the Welsh Government to fund public services in Wales.

For those living in Wales, HMRC will continue to collect your Income Tax as usual but Welsh ministers now have the powers to vary income tax rates from April next year.

This is a change from the current system, where all income tax from Wales is paid to the UK government to fund spending across the UK.

All you need to know!

The process for setting Welsh rates of income tax

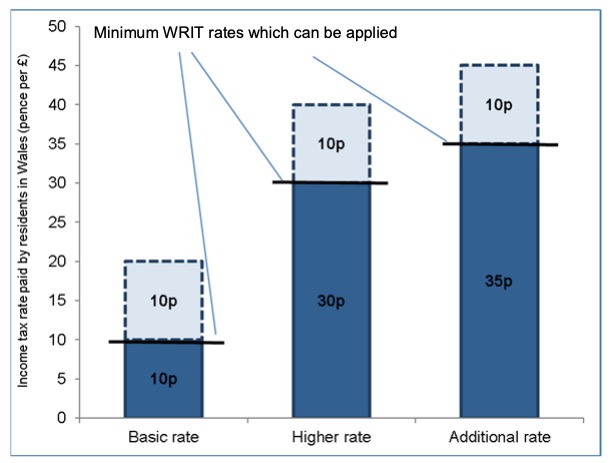

From April 2019, the UK government will reduce each of the 3 rates of income tax – basic, higher and additional rate – paid by Welsh taxpayers by 10p.

Each year, the Welsh Government will then decide the 3 Welsh rates of income tax, which will be added to the reduced UK rates.

The combination of reduced UK rates plus the Welsh rates will determine the overall rate of income tax paid by Welsh taxpayers.

The Welsh Government proposes to set the first Welsh rates of income tax at 10p: this means the rates of income tax paid by Welsh taxpayers will continue to be the same as those paid by English and Northern Irish taxpayers.

The National Assembly will need to confirm this proposal through a motion prior to the final Budget.

What will change?

Each year from 2019-20 onwards, the Welsh Government will decide whether to vary the rates of income tax paid by Welsh taxpayers or whether to keep them the same as the income tax rates paid by English and Northern Irish taxpayers.

The Scottish Parliament decides the income tax rates for Scottish taxpayers. The financial year beginning in April 2019 will be the first year in which the income tax rates paid by Welsh taxpayers will be affected by decisions made by the Welsh Government about income tax.

What will stay the same?

Income tax will continue to be collected by HMRC for Welsh taxpayers in the same way it is now.

The personal allowance – the amount people can earn before they start paying tax – will continue to be the same as it is for the rest of the UK.

The point at which people start to pay the higher and additional rates of income tax will stay the same as in England and Northern Ireland.

Responsibility for taxing income from savings and dividends will remain with the UK Government.

What will be the process for setting Welsh rates of income tax?

From April 2019, the UK government will reduce each of the three rates of income tax – basic, higher and additional rates – paid by Welsh taxpayers by 10p.

The Welsh Government will then decide the Welsh rates of income tax which will be added to the reduced UK rates. The combination of the reduced UK rates and the new Welsh rates of income tax will determine the overall rate of income tax paid by Welsh taxpayers.

If the Welsh Government sets each of the Welsh rates of income tax at 10p, this will mean the rates of income tax paid by Welsh taxpayers will continue to be the same as those paid by English and Northern Irish taxpayers.

The Scottish Government decides income tax rates for Scottish taxpayers

Could the Welsh Government set Welsh rates of income tax at less than 10p?

The reduction in the three rates of income tax by the UK government will reduce the amount of tax paid to the UK Treasury by Welsh taxpayers.

If the Welsh rates of income tax are set at less than 10p, the UK Government will recover the money it no longer collects in tax from Wales by reducing Wales’ block grant (this is the way the UK government funds Wales to pay for public services, such as the health service and education).

In order to maintain the money for public services in Wales, the Welsh Government would need to re-apply the 10p removed by the UK government to each of the tax bands.

The Welsh Government could decide that the social and economic circumstances in Wales require a different rate to be set for one, two or all three of the tax bands.

This would mean the combined rates paid by Welsh taxpayers – the UK reduced rate plus the Welsh rates – would be different to the rates paid by English and Northern Irish taxpayers.

This could also affect the amount of money for public services in Wales.

Will this affect me?

This will affect you if you are a Welsh taxpayer. If you live in Wales you will be a Welsh taxpayer, regardless of where you work.

Minimum WRIT rates which can be applied 3 If you live in Wales but also live for some of the year in another part of the UK, it will depend how much time you spend in each country.

If you live most of the year in Wales, you will be a Welsh taxpayer.

The Government of Wales Act 2006, as amended by the Wales Act 2014 provides a detailed description of who is a Welsh taxpayer.

This covers the range of different situations that could apply to people who live in more than one part of the UK during the year.

People who are elected to represent the people of Wales in the National Assembly, in Parliament or in the European Parliament will be Welsh taxpayers regardless of where they live.

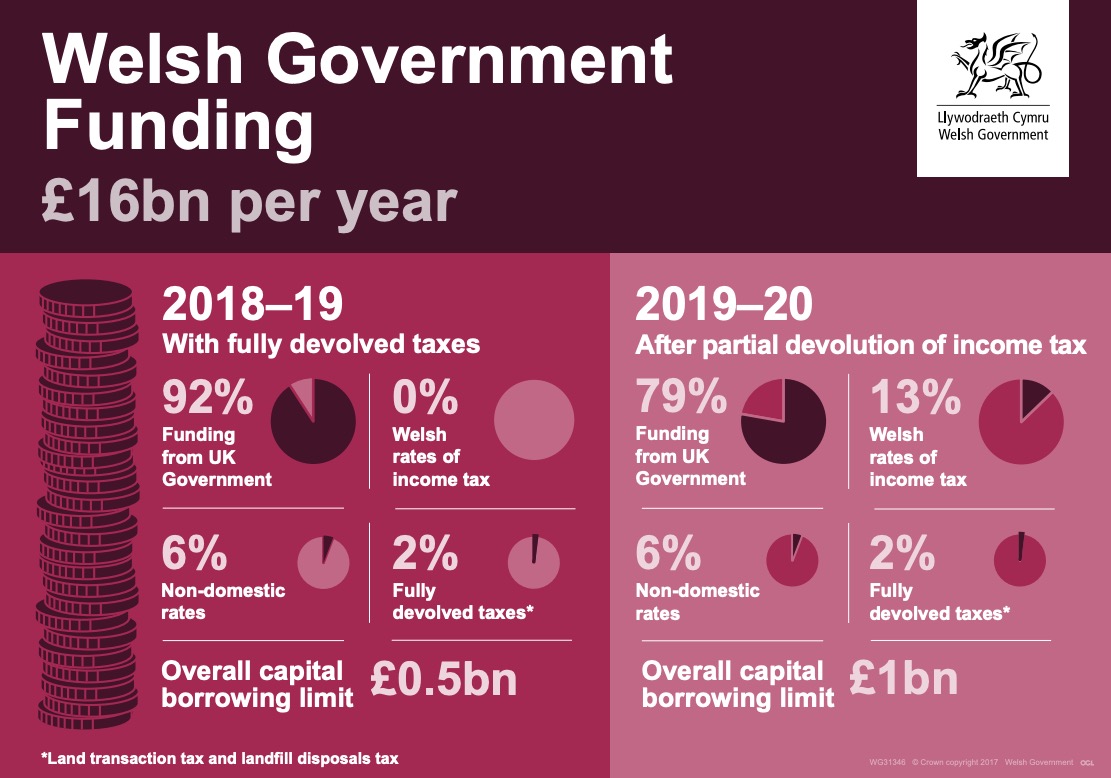

Why is this change happening?

The Welsh Government is taking greater responsibility for setting taxes in Wales, which are then spent on public services such as schools, hospitals and roads.

This decision followed recommendations by two commissions – the Independent Commission on Funding and Finance for Wales (the Holtham Commission) and the Commission on Devolution in Wales (the Silk Commission).

The commissions were asked to advise how Wales should be funded in the future. Following the commissions’ reports, the UK Parliament passed legislation to devolve taxes to Wales – the Wales Act 2014.

From April 2018, stamp duty land tax and landfill tax are no longer operational in Wales; two new taxes have been introduced – land transaction tax and landfill disposals tax.

From April 2019, the Welsh Government will decide on Welsh rates of income tax.

What are income tax rates?

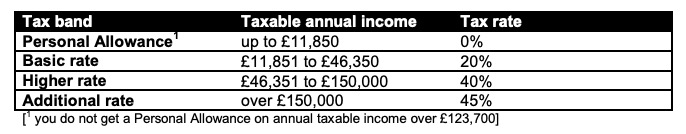

In the UK, people pay different rates of income tax depending how much they earn.

The amount payable depends on how much of a person’s taxable income is above the personal allowance and how much falls into each tax band.

Currently, the UK government decides how income tax should operate in Wales, England and Northern Ireland and, to some extent, in Scotland.

In Scotland, many aspects of income tax are decided by the Scottish Parliament. The current rates of income tax are shown in the table below.

With the exception of the highest earners, everyone benefits from the personal allowance and does not pay any income tax on the first £11,850 they earn.

People who earn less than £11,850 a year should not pay any income tax at all.

People who earn £20,000 a year will pay no income tax on the first £11,850 they earn but will be taxed at 20% on the next £8,150.

People who earn £50,000 a year will pay no tax on the first £11,850; 20% tax on the next £34,500 and 40% on the final £3,650 they earn.

How will the Welsh rates of income tax be decided?

As part of its annual budget process, the Welsh Government will propose Welsh rates of income tax for approval by the National Assembly.

The National Assembly will then vote to decide whether it agrees those rates.

The Welsh Government has committed not to increase income tax rates in Wales for the duration of the current Assembly, which is due to continue until May 2021.

Ahead of the 2021 National Assembly elections, it is expected all the political parties in Wales will set out in their manifestos what they would do with income tax if they formed the next Welsh Government.

In theory, setting lower rates could allow Welsh taxpayers to keep more of their earnings but could mean cuts to public services as less money is raised through income tax in Wales and Wales’ block grant is reduced to take account of that fall in tax revenue.

Setting higher rates could raise more money for public services in Wales but could mean taking more money from Welsh taxpayers.

In practice, the outcome of changing tax rates could be more complicated.

For example, a higher or lower tax rate might encourage more people to move in or out of Wales, which may then affect the amount of tax revenue raised.

It might also affect the decisions made by businesses to move in or out of Wales.

Future Welsh Governments will need to weigh up these factors when deciding what to do with income tax rates.

Spotted something? Got a story? Send a Facebook Message | A direct message on Twitter | Email: News@Deeside.com

Latest News